FinData: A Central Ingredient in the New Ecosystem

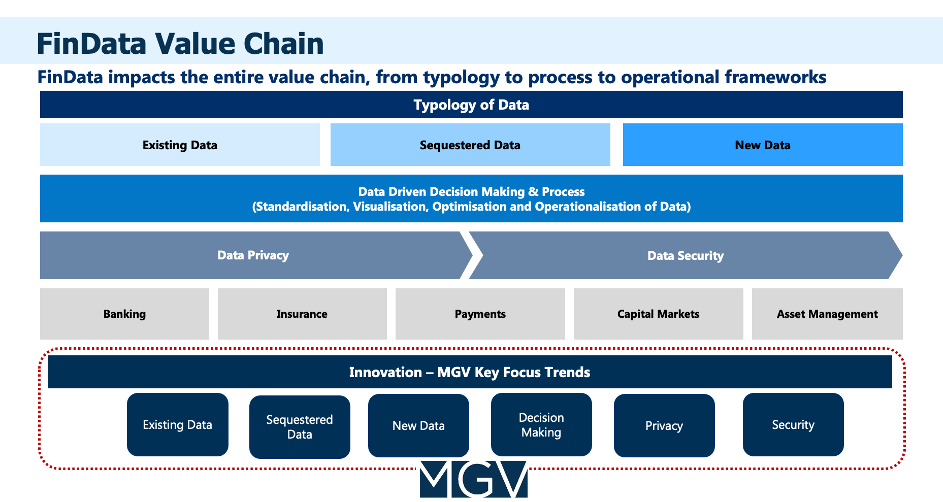

This blog, the fourth in a series, is focused on Financial Data, or what we call FinData. As we begin to put money to work in our latest fund at MiddleGame Ventures (“MGV”), we have completed a series of deep dive reviews of the FinTech startup landscape in B2B and B2B2C financial services to help structure how we prioritize our efforts across the broader fintech ecosystem. FinData is a core investment theme for MGV, encompassing both the collection and digitization of new data sources as well as the mechanisms and protocols to share and analyze data within and outside organizations.

The accumulation of data and development of analytical tools is central to the new landscape. Accordingly, the availability of vast amounts of new data (whether from unstructured data, new asset classes, or current data spun out from a business) will drive increased functionality around data analysis, collaboration, and decisioning, including through the use of new technologies such as AI or quantum computing.

Furthermore, the opening up of FinServ, is giving way to new entrants with fully digital architectures (think digital core systems, spatial biometric authentication) to provide an array of novel services on top of alternative data sources (IoT, satellites). Incumbents across financial services will thus no longer have the luxury of handling data solely within their four walls. Therefore, it will be essential to securely harness and share new data, which will inevitably create new opportunities (and new risks). We believe that all things data will quickly move to the top of strategic priorities and create an entirely new value chain.

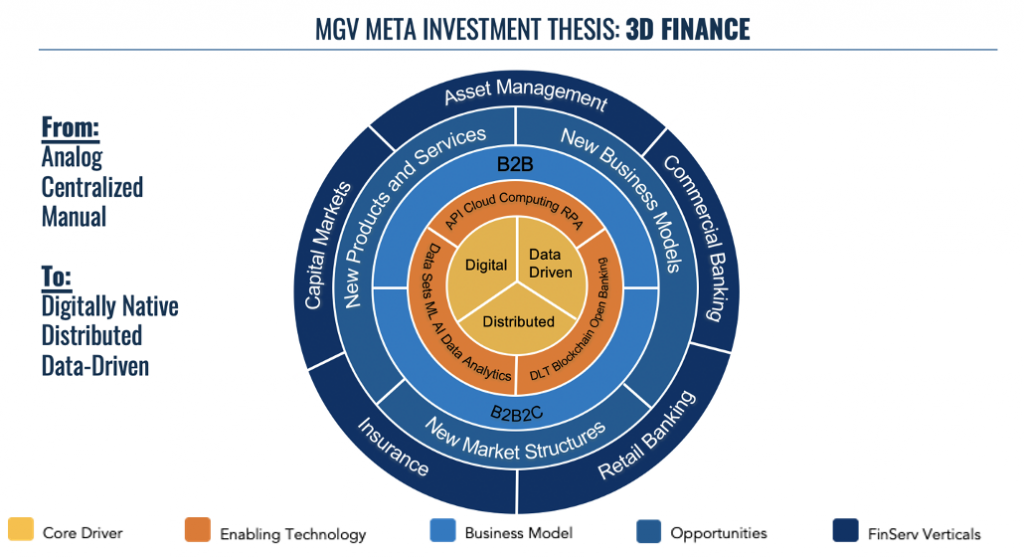

FinServ is quickly shifting from paper, people, and processes to digital, distributed, and data-driven (reflected in our term “3D Finance” explained further below). As significant (but largely inefficient) consumers of data, legacy players will have to upgrade their “spaghetti code” tech stacks to have a hope of remaining competitive in the new environment.

We see a lot of activity and interest across three core areas:

- Data computation (e.g., managing & analyzing data) via compliant methods that secure and preserve data privacy;

- Specialized vertical solutions (e.g., data privacy solutions applied to a trading venue or liquidity venue); and

- Data sharing such as synthetic data applications

Our work indicates that an army of nimble upstarts are enabling this data transformation. From frontier data ingestion (new pipelines, MLOps) to advanced data privacy/security technologies (ZKP, homomorphic encryption), new data capabilities are becoming increasingly available as computing costs decline and computing power increases.

MGV has already invested in four companies that are championing trends across various subsectors in this space (Coinfirm, Minna Technologies, Wayflyer, and Next Gate Technologies). Our research has uncovered over 500 other early stage startups attacking the opportunity across the multiple vectors outlined below. Unsurprisingly, given the core building block nature of financial data to the ecosystem, there is a diverse and growing entrepreneurial energy being brought to the fore.

Six MGV Focus Trends in FinData

We have organized our research and investment efforts around six key trends that will transform a cross-section of functions within and beyond the FinData landscape:

- Existing Data

- As the volume, variety and velocity of data sources grow exponentially, properly harnessing data remains a persistent challenge. New tools and technologies will enable better data capture (both structured and unstructured), giving way to significant cost efficiencies and enriching the entire data value chain. Capturing and harnessing existing multiplicities of data will prove a competitive advantage today but is slated to become tomorrow’s table stakes. In an intelligent, autonomous world, data will replace code, and effectively harnessing that data will prove the ultimate differentiator. To accomplish this, existing technologies (RPA/ML) will merge into frontier fields (DLT/quantum) to enable automated gateways into existing data siloes, unleashing a host of capabilities (think autonomous wealth management and embedded banking).

- Sequestered Data

- As financial institutions incorporate data into their core strategies, liberating and accessing sequestered data (both internally and externally) will become a key differentiator. Limited accessibility and interoperability across legacy systems prevents FinServ organizations from fully utilizing data. As client demands for personalized services intersect with increased competition from digital upstarts, opening doors to sequestered data across ecosystems will prove paramount in order to meet customer demands through targeted innovation. In the meantime, new data in-flows will give rise to a host of new products, business models, and structures governing organizational decision-making. In their purest form, APIs will serve as digital highways for open data services in interconnected ecosystems, ensuring legacy businesses do not become obsolete

- New Data

- What began as simple entry points into alternative data sets (social media data, mobile data) is evolving into a host of new gateways and data streams, with significant potential. Advanced technologies will improve the diversity and quality of this new wave of data formats, which will have a direct, positive impact on decision making (and returns) for early adopters. Powered by the accelerated adoption of devices (IOT sensors, wearables, intelligent cameras) and digital use cases (metaverses, crypto, voice-powered services), FIs have an ocean of data opportunities to explore. These opportunities will require significant data preparation/cleansing technologies, which will in turn fuel a revolution in business analytics. Good, relevant data will help organizations derive valuable insights to feed predictive AI/ML models driving decisions. These efforts will be aided by innovative software solutions that will accelerate (and automate) data preparation.

- Decision Making

- The value of data is often greater than the sum of its parts. For financial institutions, the use of data enables better strategic insights, enhanced decision-making, and increased value for clients. Advanced technologies, largely driven by innovations in AI (reinforcement learning, deep learning) are democratizing access to data and the resulting decisioning. Instead of restricting capabilities to data analysts who can code, entire organizations will soon be able to harness the power of new data in their decision-making process. Through advanced data assessment, the balance of machine vs. human in FinServ decision-making (lending decisions, insurance claims) will shift from 50/50 today to 80/20 in the medium-term (beginning with bypassing manual data entry, which costs $7B+ annually). Artificial intelligence and related underlying technologies are reaching an inflection point across multiple FinServ use cases. Deployed at scale, these technologies will ease data management, drive data-informed decision making, and enable scalable production in a variety of B2C and B2B applications.

- Privacy

- Data privacy is gaining urgency from all angles, including regulatory and consumer pressure. Once considered a check-the-box protection, privacy protection is slated to become a core business differentiator. Emerging privacy enhancing techniques (PETs) have the potential to fundamentally alter organizational dynamics around privacy by reducing or eliminating the risks of sharing and/or mishandling data and creating opportunities to realize new forms of value. Future privacy systems will require end-to-end anonymization, synthetization, and permission management of data with zero risk of re-identifying customer information. These structures will incorporate methods for synthesizing (or distributing) financial datasets that follow the same properties of the real data while respecting the need for privacy of the parties involved in financial interactions. Fundamentally, an increasingly open financial system will require a paradigm shift around data privacy, enabled by frontier technologies (ZKP, MPC, synthetic data) to ensure end-users remain the ultimate proprietors (and beneficiaries) of their own data and the associated meta data.

- Security

- Financial systems are amongst the most targeted across the cyber universe, with cyber attacks posing a substantial risk to the stability of the overall financial sector. New forms (and growing sophistication) of cyber threats will force ill-equipped organizations (from SMEs to large enterprises) to adopt new technologies and revamp security systems. This begins with data security. Data security (and the technologies ensuring it) will play a foundational role in the emerging data ecosystem. As hyper-connectivity accelerates, so does the risk of fraud, hacking, and data compromise, and other cyber-vulnerabilities. Frontier security technologies such as MPC (multi-party computation) will help organizations maintain an appropriate balance between security and customer convenience. Though quantum computers do not have enough compute power to break encryption keys today, quantum-resistant cryptography technologies will determine the long-term trajectory of data security.

3D Finance

These focus trends in FinData tie into MGV’s “3D Finance” meta thesis, which encompasses the transformation of financial services around a core of Digital, Distributed, and Data-Driven processes. Within the 3D Finance construct, we have further developed investment themes that focus our attention on the transformation that is just beginning to unfold across the financial services industry, many of which were highlighted on MGV’s introductory blog.

Conclusion

If you are a high-potential pioneering startup in the FinData ecosystem or if you are an incumbent seeking to identify opportunities within this ecosystem, please reach out to us. We are committed to supporting the transformation of financial services over the next decade and welcome any and all feedback and opportunities to engage constructively on a shared vision for the future of financial services.

Stay tuned for follow up posts on additional verticals of interest to the investment team (also see our first three posts in this series on Open Banking, OmniFi, and Capital Markets & Asset Management).

Acknowledgements

In addition to the MGV team, underlying research credit goes to Clement Parramon and Inder Takhar, with support from Matt Lobel.