As we begin to put money to work in our latest fund at MiddleGame Ventures (“MGV”), we have completed a series of deep dive reviews of the FinTech startup landscape in B2B and B2B2C financial services to help structure how we prioritize our efforts across the broader fintech ecosystem. This blog, the second in a series, is focused on OmniFi. OmniFi is our term for the financial services spectrum spanning the current centralizing characteristics from Centralized Finance (CeFi) to the emerging power of Decentralized Finance (DeFi) while encompassing a host of applications (tokenization, fractionalization) that are being built on top of blockchain systems.

OmniFi

This next decade of OmniFi, and therefore FinServ, will usher in fundamental shifts in market structure and data asymmetries through increased decentralization (more open source, more disintermediation, more distribution) driven by leaps in infrastructure-layer innovation. However, we do not believe in extreme decentralization (where value may accrue incongruously) nor in status quo centralization (where value may accrue in a black box), but in a merging of the two into more efficient, more open financial systems – hence, our term OmniFi.

To clarify, we do not believe that one system or governing structure (CeFi or DeFi) will “win” – hence, we are not “maximalists” or proponents of one system at the expense of the other. Rather, we believe the main ecosystems that comprise OmniFi will converge over time into something better. Further, we believe that many aspects of OmniFi will significantly impact Open Banking and similar movements in capital markets, asset management, and other verticals to create a true era of Open Finance. Better said, OmniFi is the transitional competitive milieu over the next decade that will lay the groundwork for Open Finance.

For example, new ways to issue assets (tokenization, digitization, blockchain/DLT) will lead to new asset classes, driving a drastically different value chain in capital markets and asset management, helping pave the way for new frameworks to drive financial innovation outside legacy systems and infrastructure.

MGV has already invested in two companies that are championing trends in this space (Coinfirm, Nivaura, and Keyrock). Our research has uncovered nearly 400 other early stage startups attacking the opportunity across multiple vectors employing a cross-section of technologies (DLT, Ai, RPA, Data Analytics). Simply put, there is enormous talent and energy focused on innovating the core infrastructure of the financial system. This is a natural evolution from the exponential rise of bitcoin and cryptocurrencies, to NFTs, to the ICO craze, to now: a serious rebuild of infrastructure by fantastic teams attacking real opportunities.

We have organized our research and investment efforts around seven key trends that will transform a cross-section of functions within and beyond the financial services landscape:

- Enterprise Blockchain: Manual, paper-intensive workflows for internal and cross-organizational reconciliation will become digitized, creating significant efficiencies and cost savings for incumbents across horizontal processes (e.g., post-trade issuance/settlement, regulatory reporting). These changes will create new market efficiencies (lower friction, regulatory risk) for both the buy side and sell side while providing the rails for a wide array of innovations (e.g., multi-party data sharing, fully-digital shares upon origination). Early leaders have emerged here including Axoni, Ripple, Symbiont and Clearmatics. New entrants are attacking attractive use cases across all verticals, from capital markets to insurance.

- CeFi (Centralized Finance): Driven by growing awareness, retail crypto adoption is being catalyzed by emerging crypto startups (Coinbase), retail trading startups (Robinhood), regulated exchanges (Gemini, ErisX), and payments firms (Square, PayPal). However, to enable widespread retail and institutional adoption (e.g. banks, asset managers, family offices), the sector needs to make a giant leap forward from Crypto v1.0 today. Processing time (10 min/transaction for Bitcoin), scalability (unsustainable energy consumption), and privacy/security concerns (seven exchange hacks in 2019 alone) remain stubborn impediments to widespread institutional adoption. However, change is afoot. In tandem with increased regulatory acceptance, multiple Central Bank Digital Currencies (CBDCs) and an abundance of tokens/ cryptocurrencies will continue to spur private sector innovation (e.g., new transaction mediums) and reduce dependence on centralized payments systems (e.g., SWIFT, CHIPS).

- Tokenization: Technology will seed widespread tokenization across nearly all asset classes, including physical assets such as crude oil or real estate, financial assets such as stocks or other securities, and, of course, crypto assets. This will drive issuance and trading innovation and will also enable new downstream services in administration, servicing, and custody. As tokenized infrastructure becomes increasingly robust, future token projects will ultimately leverage both decentralized systems (which emphasize trust) and centralized systems (which emphasize efficiency and compliance) to create unique incentive structures catalyzing a new wave of financial services innovation. With increased interoperability and fungibility across assets, investors will be empowered to pursue novel investment strategies untethered to legacy infrastructure. A further enabler will be fractionalization, which is certainly not the same as tokenization although many seem to merge the two concepts (all tokenized assets are fractionalized, but it is important to note that not all fractionalized assets need be tokenized).

- DeFi (Decentralized Finance): DeFi is premised on the full decentralization of FinServ by reinventing how assets are issued, traded, and held (contra to the constructs of incumbent banking and all centralizing agents). However, this will not happen overnight. While we believe DeFi will follow Amara’s law (overestimated in near-term, while underestimated longer-term), decentralized infrastructure today is already being built for lending, borrowing, trading, and derivatives – in the process enabling +20x cost savings versus fully centralized systems for a niche set of users. Though unlikely to exist in its purest and extreme incarnation, lessons from DeFi will converge with centralized infrastructure to give way to cheaper, faster, and more transparent FinServ.

- Self-Custody: An important innovation that will revolutionize asset management, self-custody technologies is a key enabler for new forms of FinServ that will unlock the entire custody chain by giving institutions and individuals enhanced control over the ownership and trading of both new and existing assets. Aside from regulatory uncertainty, insufficient custodial solutions and asset security remain the biggest roadblocks to institutional adoption of the crypto asset class. Unlocking value in this segment is premised on private/public key technology, which would allow for the complete revamping of the custody of assets, thus pioneering an entirely new ecosystem by giving the asset holder ultimate control (in this case, custody) over one’s assets.

- Reinventing Governance: New voting structures enabled by blockchain – including on-chain digital voting and proof of stake models – will reimagine, reshape, and ultimately reinvent corporate governance structures in the information age. Blockchain systems have unique properties (peer-to-peer digital voting, censorship-resistance) that can mitigate human error/self-interest in governance (i.e., the principal-agent problem) by augmenting or replacing agents with smart contracts, smart property, and code. In a financial future with private/public keys, one can contemplate the merger of proof of stake and governance that are controlled by the asset holder and where activism and voting take on a completely different meaning, whether baked in the code of a particular asset or a posteriori. Put differently, one can imagine a straight line path to fully actualized ESG directives via transparent and direct governance.

- Risk & Data Management: Institutional adoption of digital assets and OmniFi is contingent on appropriate risk and data management. Thus, the growth of OmniFi will require a whole new class of providers (oracle as a service, data analytics, KYC/ AML, cybersecurity, insurance) to leverage new data sets and data flows and ensure on-chain and off-chain data connectivity, including institutional standards of security, compliance and legal safeguards. The advent of zero-knowledge proofs, multi-party computation, and homomorphic encryption are technological breakthroughs that will drive institutional crypto adoption. These technologies not only ensure privacy and security in financial transactions, but also offer a more efficient, lower cost way to exchange information.

3D Finance

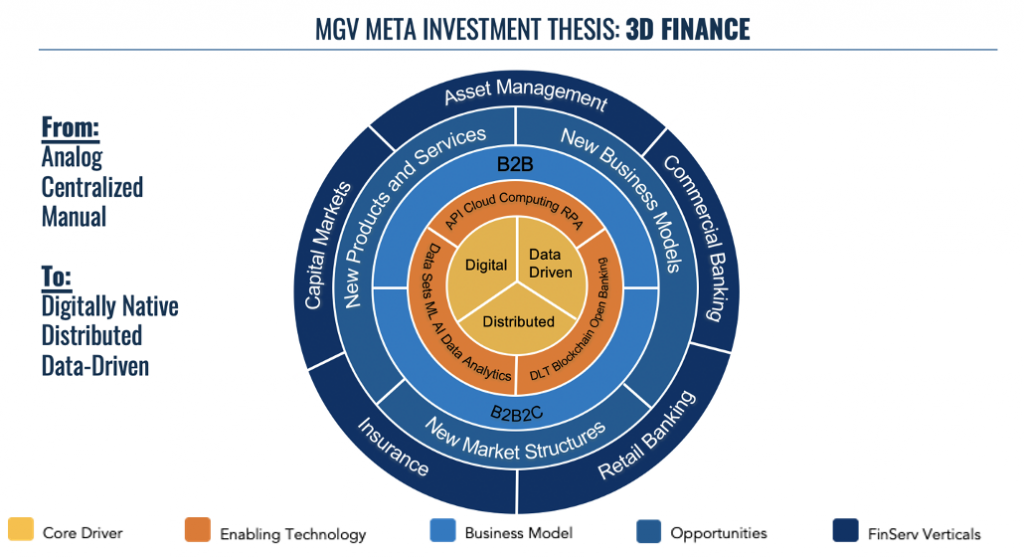

These focus trends in OmniFi tie into MGV’s “3D Finance” meta thesis, which encompasses the transformation of financial services around a core of Digital, Distributed and Data-Driven processes. Within the 3D Finance construct, we have further developed investment themes that focus our attention on the transformation that is just beginning to unfold across the financial services industry, many of which were highlighted on MGV’s introductory blog.

If you are a high-potential pioneering startup in the OmniFi ecosystem or if you are an incumbent seeking to identify opportunities within these emerging ecosystems, please reach out to us. We are committed to supporting the transformation of financial services over the next decade and welcome any and all feedback and opportunities to engage constructively on a shared vision for the future of financial services.

Stay tuned for follow up posts on additional verticals of interest to the investment team, including: Capital Markets & Asset Management, FinData, and ESG (also see our initial post in this series on Open Banking).

Acknowledgements

In addition to the MGV team, underlying research credit goes to Inder Takhar, with support from Matt Lobel.