As we at MiddleGame Ventures (“MGV”) begin to put money to work in our latest fund, we have completed a series of deep dive reviews of the FinTech startup landscape in B2B and B2B2C financial services to help structure how we prioritize our efforts across the broader fintech ecosystem. This blog, the first in a series, is focused on Open Banking (OB).

Opening Banking

Open Banking, seeded by forward thinking regulation in the UK and EU (PSD2) and accelerated by new technologies and customer preferences, is redefining the role of global banking services and opening up a host of new businesses along the way. MGV has already invested in two companies that are championing trends in this space (Minna Technologies and Railsbank). Our research has uncovered over 500 early stage startups attacking the opportunity across multiple vectors including middleware technology providers, platforms, and privacy tools. In short, there is a lot of energy and opportunity in this space.

Over the past decade, the banking paradigm has radically changed with the rise of dozens of new channels and platforms that are disintermediating traditional providers of banking and payments services and broadening the scope of customer engagement (e.g., SMEs). As these trends play out, we believe the payments and application layers in the OB ecosystem are best positioned to benefit, while incumbent banks will need to revaluate and reinvigorate their value proposition. Whereas, other non-traditional financial verticals stand to benefit from the expansion of payments and finance rails.

Customer expectations (transparency, tailor-made products, omni-channels), new entrants (big tech, fintechs, neobanks), new technologies (API integrations, cloud banking, DLT), and regulations (PSD2, GDPR) are the core enablers for OB and will drive the expansion of OB-like innovation beyond the banking and payments sectors. As OB schemes proliferate, Open Finance and Embedded Finance will dominate the future of FinServ, leading to the emergence of a meta financial universe that blurs the financial and non-financial sectors (more to come on these themes later).

Six MGV Focus Trends in Open Banking

We have organized our research and investment efforts around six key trends, that implicate payments and banking, in addition to other financial services verticals:

- Network Interoperability: The fundamental stitching (i.e., middleware and technology enabling platformification) of the new ecosystem will broaden the banking and payment rails to allow for the networking of accounts and functions for use by consumers, financial institutions, and third-party service providers. This will unleash a wave of innovation between traditionally siloed incumbents (FIs, payment networks) and a host of fragmented economic actors (corporates, SMEs).

- Customer Engagement: OB will expand the ability to leverage data and new platform connections to broaden product offerings to new customer segments. For example, the white-labeling of AIS or PIS, cash management solutions, B2B payments, and tax assistance are examples of previously unattainable or uneconomical channels for integrated services to new or existing clients. In particular, expanded SME services is an important new avenue. Overall, increased interoperability will reduce friction and allow for the emergence of closed networks that foster better payments functionality, greater customer loyalty, and lower costs – enabling the proliferation of e-wallets and greater use of IoT devices, with attendant economic and data benefits.

- Identity, Privacy & Security: Privacy enhancing techniques (PET) and identity are key to reducing friction and enabling new linkages across OB marketplaces through added security for users – and are thus well positioned to become the central rails of the new OB ecosystem. Without the ability to unify and aggregate customer information in a seamless manner, the benefits of platforms and account linkages will be more difficult to realize for a host of participant verticals across the ecosystem. Examples of enabling technologies include differential privacy, federated analysis, homomorphic encryption, zero-knowledge proofs, and secure multi-party computation (MPC).

- Crypto to Fiat: Two separate universes will collide and interact as the facilitation and integration of digital currencies will exponentially drive growth by enabling an interoperable world between traditional and digital currencies. This will open up a host of new opportunities and asset classes that will expand the boundaries of OB, and open up new avenues for innovation in payments and banking (and beyond). As digital asset adoption accelerates, open banking will pave the way for startups ushering in new, blockchain-secured systems and crypto-fiat rails.

- Open Banking to Open Finance: Beyond Open Banking, we predict the near-future emergence of the wider concept of “Open Finance”, expanding customer data shared within the fintech ecosystem to lending, investments, pensions, etc. Historical barriers to entry in financial services (regulatory, customer data, core systems) are disappearing with the development of “as-a-service” platforms across an array of financial verticals. DLT will help Open Finance expand globally via secure data storage and management solutions that will shift the burden from the institution for data privacy to the individual via self-sovereign identities (i.e., the ability to create and secure digital identity management that enables trust by empowering consumers). We believe the self-custody a customer’s bank account represents a key enabling bridge to broader Open Finance use-cases.

- Metaverses & Embedded Finance: The redefinition of financial services outside the traditional FinServ vertical, reflecting the merging of FinServ, BigTech, FinTech and other non-financial services participants will redefine the legacy boundaries of financial services. “Embedded Finance” is the integration of financial services tools and applications to non-native financial services businesses, enabling non-financial companies to enhance or even transform value propositions through embedded financial products and services (e.g., payments, lending, wealth, investments, insurance). This, in turn, will enable the emergence of a meta financial universe (persistent, interoperable, dynamic and synchronous) that will seed the vertical integration of financial applications into non-financial ecosystems. (Again, more to follow on this in a subsequent blog.)

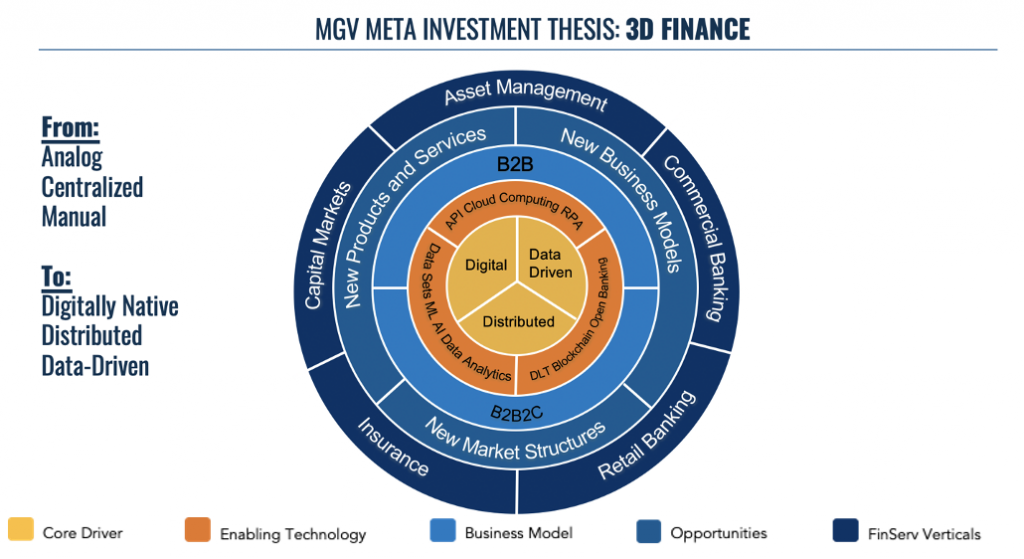

3D Finance

These trends in Open Banking and beyond tie into MGV’s “3D Finance” meta thesis, which encompasses the transformation of financial services around a core of Digital, Distributed and Data-Driven processes. Within 3D Finance, we have further developed investment themes that focus our attention on the transformation that is just beginning to unfold across the financial services industry, many of which were highlighted on MGV’s introductory blog.

If you are a high-potential FinTech startup attacking core pieces of the Open Banking/Open Finance value chain or if you are an incumbent seeking to identify opportunities within these emerging ecosystems, please reach out to us . We are committed to supporting the transformation of financial services over the next decade and welcome any and all feedback and opportunities to engage constructively on a shared vision for the future of financial services.

Stay tuned for follow up posts on additional verticals of interest to the investment team, including: Capital Markets & Asset Management, FinData, ESG, and OmniFi (our term for the spectrum of blockchain and DLT based centralized to fully decentralized finance).

Acknowledgements

In addition to the MGV team, underlying research credit goes to Antonin Gury-Coupier, with support from Inder Takhar and Matt Lobel.