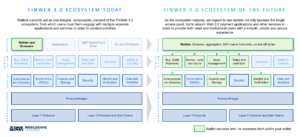

We foresee the potential for a dramatic shift in financial services delivery where Wallets become the central nervous system of a decentralising financial ecosystem.

Wallets are poised to create the requisite bridge between Web 2.0 and Web 3.0 by establishing a digital authority manager and fulfilling the ‘super app’ promise of Web 3.0. Ultimately, while the timing is uncertain, we believe that Wallets will provide the single biggest opportunity for new entrants and pose the greatest threat to incumbent financial service providers.

Wallets can be defined as software or hardware which enable both retail or institutional users to access crypto, fiat and digital assets on their own. Wallets do not hold any currency – they store the information needed to complete transactions and access funds/assets.

A NEW CENTRAL NERVOUS SYSTEM

Wallets provide a single account to access the entire ecosystem. Wallets enable users (retail, SMEs and institutional) to have ownership over and manage their own account to access the entire financial ecosystem. As a result, Wallets have the potential to consolidate access to financial services commonly associated with Web 2.0 (e.g., fiat payments) and new Web 3.0 capabilities.

The evolution of the Web has enabled this change. For example, during the first iteration of the Web, users were required to create a different account (e.g., login details) for each and every application. The rise of Web 2.0 enabled centralised third parties (e.g., Facebook and Google) to store, manage and own a user’s account details and act as the middleman when providing access to applications. Web 3.0 turns the relationship with centralised third parties on its head and allows users to own and manage their single account (i.e., their Wallet) and thus providing ownership across multiple functions.

The way in which Wallets operate varies significantly. There are four levers that determine the key characteristics of a Wallet: custody, storage, chain and authentication. Each of these levers can be flexed to suit the specific needs of the use case at hand.

KEY TRENDS WE ARE MONITORING

The key trends below should be understood within the broader context of early innovation cycles with large volumes of experimentation and investigation characterised by a vast number of early-stage projects.

- Rise of institutional wallets

- In order for crypto to achieve mainstream adoption, enterprises and institutional players must take part

- Many initial Wallet offerings are focused on non-custodial solutions for retail customers and therefore do not meet institutional requirements from a security, storage, multi-party authentication and volume perspective

- We have seen a rise in institutional Wallets that are custodial by design, enabling enterprise players to gain access to crypto and broader Web 3.0 exposure

- There has been increased partnership between Wallets and crypto custodians (e.g., BitGo, Qredo and HexTrust) in order to provide services to multi-billion dollar enterprises

- Proliferation of wallet types

- Wallets have developed to reflect the continually evolving use cases and number of blockchain protocols within the ecosystem

- As a result, we have seen the proliferation of multiple types of Wallets, each designed to optimise for a specific chain, activity or service. For example, Argent is designed for Ethereum assets, or Yoroi to support Cardano transactions

- We expect Wallets to evolve to cater to this increasingly decentralised ecosystem, resulting in the development of Wallets for transaction, Wallets for NFTs, Wallets for gaming, Wallets for DeFi etc.

- Simple and frictionless user journeys

- It can take over 10 ‘clicks’ and require movement between multiple platforms to set up a Wallet or validate a transaction using a private key using current providers. Cumbersome and long-winded customer journeys result in churn and hinder mainstream engagement

- There has been a rise in Wallets aiming to extract away these points of friction and provide simple and engaging customer journeys

- Mobile-first Wallets enable users to set up a Wallet in under five minutes, self-custody their assets without needing to remember a Seed Phrase and apply multi-sig security when needed to improve security and safeguarding of assets

- Security and key recovery

- Non-custodial Wallets often require users to remember / store their Seed Phrase and Private Key. If lost, these critical items are unrecoverable and therefore users lose access to all their digital assets. The risk around losing access to digital assets acts as a barrier to entry for those new to the Web 3.0 space, as well as institutional actors who are responsible for large volumes of assets

- In a drive to improve usability and access, some Wallets are testing ways in which users can recover their Seed Phrase or Private Key. For example, users can nominate ‘Guardians’ or trusted individuals who can help them recover or unlock their accounts, as well as provide a secondary signature to increase security (Multi-sig)

- Multi-chain as the new standard

- The proliferation in blockchain protocols has resulted in the rapid growth of Wallets to support those specific protocols. As a result, Wallets can provide siloed and limited user experiences within one protocol network. Users are therefore unable to transfer or engage with digital assets or dApps which run on chains not supported by their Wallet of choice

- We are seeing existing Wallets begin to pivot towards supporting a multi-chain ecosystem with the end goal of ultimately supporting all chains and digital assets built on top of those chains in order to maximise engagement

- Many Wallets choose to support Ethereum initially, due to a large active user base and volume of assets on chain; however, Wallets are now beginning to integrate with additional protocols

- The emergence of multi-sig

- Initially crypto Wallets required a single signature to authorise a transaction and transfer assets to another Wallet. Single signature authentication of transactions provides limited security and therefore often deters institutional and some retail users who require more bespoke custodial solutions for the safeguarding of their assets

- Over time we will see the rise of native multi-chain Wallets in order to support the multi-chain ecosystem and optimise for interoperability

- The rise of multi-sig provides the required security, consensus and enterprise-grade infrastructure for large corporates who hold sizable funds for themselves or on behalf of clients. Multi-sign also enables the execution of escrow-style transactions whereby a third party can act at the intermediary

FUTURE TRENDS

In order for wallets to secure their place as the central nervous system of the decentralised finance ecosystem, we will witness a number of key transformations across the end-to-end tech stack.

Key future trends include:

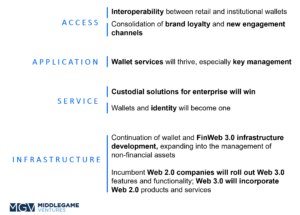

Access

- Retail and institutional offerings will become inextricably interlinked

- In the near-term, separation between retail and institutional channels will provide end-users with additional comfort and confidence in the underlying technology

- Retail and institutional Wallets alike must first mature in their offerings, reach the required levels of compliance, security and robustness, and thus create a stable foundation for the convergence of retail and institutional channels

- In the medium to long-term, there will be an acceleration of interoperability between these channels as providers seek to offer a more efficient and customer-centric user journey

- Consolidation of brand loyalty and new engagement channels

- At present, users (both retail and institutional) are required to ‘shop around’ to determine the best Wallet for their specific use case resulting in limited brand loyalty and high customer churn between Wallets

- However, as the Wallet ecosystem continues to mature, we will expect to see an entrenchment of Wallet brands

- This will be particularly prevalent in the institutional Wallet vertical whereby users face stronger inertia when moving providers due to the more comprehensive operational activities required such as security, compliance and the volume of assets under management

- Wallet activity will provide a new layer to a user’s digital reputation which can then be leveraged across the entire FinWeb 3.0 ecosystem. Wallets reflect a user’s on chain activity which in turn could become the new ‘newsfeed’

Application

- Wallet services will thrive, especially key management; custodial solutions for enterprise will also succeed

- Key management will become central to Wallet design, construction and customer retention

- The ability to offer customers a plug-and-play middleware whereby they can toggle multi-sig on and off in parallel to custody options will result in the rise of a hybrid Wallet vertical (Wallet-as-a-service)

- Wallet services will mature by absorbing both Web 2.0 applications and services across the full payments cycle (e.g., peer-to-peer and bill pay) and current account value chain

- Wallets and Wallet services that enable the gap between Web 2.0 and Web 3.0 to be bridged, such as Wallet security, compliance and scaling solutions will thrive

Service

- Wallets will become the data vaults of Web 3.0

- At present, self-sovereign identity solutions for Web 3.0 are often packaged as a stand-alone solution that is layered on top of the wider ecosystem

- However, the overlap between Wallets and identity will continue to evolve, ultimately becoming synonymous. Wallets will be understood as the verified identity of the user(s), authenticated via the single or multi-sig parameters put in place

- Wallets will become universal identifiers and the superior data manager for all engagement within Web 3.0. For example, RabbitHole enables users to share skill badges (similar to the ‘Professional Experiences’ and ‘Certifications’ section on LinkedIn)

- More than this, Wallets will consume, manage and store all sorts of data beyond identity and thus create new verticals to deeper customer engagement and opportunities for commercialisation

Infrastructure

- Wallet and FinWeb 3.0 infrastructure development will expand into the management of non-financial assets

- We expect further infrastructure upgrades in both the Ethereum alternative Layer 1 ecosystems and NFTs. As a result, we expect these infrastructure upgrades to positively impact Wallet applications and use cases, leading to greater adoption across both retail and institutional channels

- Greater institutional engagement will create a positive flywheel effect resulting in additional Wallet infrastructure investment and accelerating the maturity of innovation cycles

- We will see the development of Wallet infrastructure beyond financial services applications and towards legacy non-financial assets such as personal data, photos and messaging

- Wallets will become the central touch point through which users engage with online applications and the wider Web 3.0 community

- Incumbent Web 2.0 companies will roll out Web 3.0 functionality; Web 3.0 will incorporate Web 2.0 products/ services

- In the near-term we will see a more dramatic convergence of Web 2.0 and Web 3.0 as Incumbents and FinTech alike try to cement their relevance with the emerging ecosystem, and Web 3.0 entrants create bridges from the ‘old’ infrastructure for the market to follow

- Robinhood began rolling out their new Wallet offering to 1,000 customers at the start of 2022, enabling them to send and receive crypto between Robinhood and other external crypto Wallets. Beta testers are limited to 10 transactions per day and are required to complete two-factor authentication to ensure security

- In addition to the current custodial crypto offering, Revolut plans to release a non-custodial Ethereum Wallet with the aim of becoming multi-chain in the long-term. The move unlocks the possibility for users to engage more widely in the Web 3.0 ecosystem and participate in staking and lending activities

REGULATORY CONSIDERATIONS

Regulators are poised to apply frameworks to protect customer interests and guard against bad actors. Recent market developments, highlighted by Terra and Celsius, will add greater urgency to these efforts with the potential to broaden the scope of regulatory action.

The majority of crypto assets are not included within the scope of the EU’s Financial Services Legislation and therefore are not regulated. The EU has begun to address the lack of regulatory clarity via two main frameworks, the Financial Action Task Force (FATF) and the Regulation on Markets in Crypto Assets (MiCA). While new regulations will create a number of near and long-term challenges (seen most recently with the crypto KYC/traceability legislation), better visibility on the guardrails for the sector will ultimately bring greater clarity and in turn help drive mainstream adoption.

In summary, although today Wallets act mainly as an access point from which users can access digital assets, crypto and Web 3.0, over time they will expand to incorporate other verticals / layers within the underlying technology stack creating a bridge between Web 2.0 and Web 3.0, fiat and crypto, for the market to follow.

—–

If you would like to find out more about our MGV FinWeb 3.0 thesis, see here.

Launching a venture in the Web 3.0 wallet or blockchain space? Want to pitch us on anything else? We’re seeking outstanding entrepreneurial teams who are reimagining the new financial services architecture. If that’s you, get in touch here.