Financial services and the Web are changing dramatically. At MiddleGame, we believe that the accelerating convergence of financial services and the Web will give rise to new market structures and services, signalling a fundamental re-architecting of the global economy’s core. FinWeb 3.0 envisions the rise of a decentralised Web acting in concert with a redefined financial ecosystem.

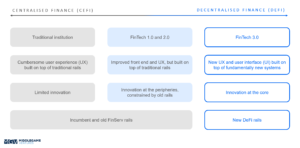

We are at the beginning stages of a long-term shift from a siloed and opaque financial ecosystem towards a decentralised tech stack comprised of highly composable layers. Legacy financial services rails will be replaced. New and improved user experiences will be built on top of fundamentally new systems and infrastructure. Innovation will occur at the core, extending beyond the front-end or the middleware and casting aside the constraints of the old infrastructure rails. Control will shift away from a centralised base of actors to a more democratised and accessible financial ecosystem. We see significant opportunity for new entrants and savvy incumbents in this new ecosystem. While the changes will be seismic and far-reaching, this new world will not develop overnight, particularly as regulators engage more closely.

The most immediate and exciting area of innovation will focus on bridging the gap between centralised financial systems (CeFi) with the new decentralised financial infrastructure (DeFi), creating channels from Web 2.0 to Web 3.0 for the market to follow. CeFi can be understood as financial systems that require or rely on a central entity to perform or execute activities on behalf of the end user, often leading to inefficiencies, product silos and value leakage for the user. Conversely, DeFi refers to a new financial system (inclusive of products and services) that leverages blockchain technology and does not rely on, or require, financial intermediaries to perform activities. In theory, removing the middleman creates more value for the end-user.

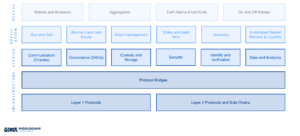

The DeFi ecosystem can best be understood as a series of composable layers that build on each other to create an open and highly interoperable ecosystem.

The DeFi Ecosystem

The infrastructure layer represents the underlying blockchain protocols and rules by which activities within the ecosystem occur. These rules are often executed via smart contracts that enforce activities when the prescribed conditions are met. Blockchain protocols often operate with specific applications and users in mind. This has resulted in their continued proliferation (over 200 active blockchains/protocol systems in existence) as more are built to solve for the myriad of existing, and even new, use cases which could benefit from blockchain application.

The service layer consists of composable services which can be leveraged by applications and access providers or as stand-alone products. Many of these use cases reflect traditional financial services such as security, identification, communication and data analysis. However, the way in which these services are conducted differs significantly due to the unique nature of the underlying DeFi blockchain infrastructure.

The application layer is a series of processes which draw on the infrastructure and service layers to create products with applied use cases. Many of these use cases reflect activities seen in traditional finance such as buying, selling, lending and asset issuance. Additionally, as an entirely new innovation, DeFi has enabled the rise of new financial products and services such as staking, tokenisation and automatic market makers (AMMs).

The access layer is the entry point for customers and end-users of DeFi applications. Vendors provide aggregation services to connect various applications across vertical layers of the tech stack and provide improved and more accessible user experiences (UX / UI). For example, Wallets (such as MetaMask) are available as web browser extensions and mobile apps that provide a gateway for users to connect to other blockchain-based applications.

New entrants are fast appearing, however significant opportunity remains

As noted, in order to fully realise the DeFi future, the gap between the CeFi and DeFi ecosystems must be bridged. We highlight a number of areas where we expect to see continued innovation by startups and incumbents alike, as well as segments of the legacy CeFi value chain that are ripe for disruption.

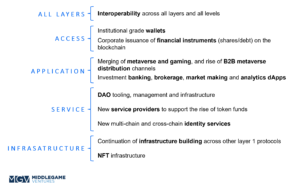

Infrastructure

- Ethereum upgrades: Continued Ethereum infrastructure upgrades including Layer 2 scaling solutions, protocol bridges and Proof-of-Stake will lead to investment opportunities in cross-chain interoperability and payments processing (both crypto to fiat and crypto to crypto)

- Institutional adoption: Institutional adoption will likely triple from approximately 15% of market/transaction flows. Increased institutional engagement will spur infrastructure investment

- Layer 1 development: Infrastructure building within other Layer 1 protocols will continue. We will follow attentively the development of Solana, Cosmos, Polkadot, Avalanche, Tezos and Terra — the operating systems of Web 3.0

- Cross-chain security: As we take steps towards a multi-chain future, there will be an increasing need for cross-chain security solutions to guard against the vulnerability to 51% attacks (gaining control of over 50% of a blockchain’s hashing power can prevent new transactions from being confirmed and rewrite parts of the blockchain)

- NFT infrastructure: We acknowledge current speculation and the multilevel marketing qualities of the market, yet the creation of NFT assets offers an interesting avenue for the democratisation of existing and new asset classes. NFT infrastructure initiatives will be of keen interest for us going forward

Service layer

- DAO use case maturity: DAO (Distributed Autonomous Organisations) will mature and offer applications for legal and coordination purposes applied to various financial services value chains

- DAO tooling: Infrastructure and solutions that facilitate the creation and management of DAOs will be of particular interest

- Fund tokenisation: Funds (alternative and publicly traded) will start to experiment with issuing LP or GP interests in a tokenised form, thereby spurring growth with new service providers specialised in bringing funds to market. Token fund management, accessible token fund launch tools and tokenisation solutions are of particular interest

- Institutional tokenisation: Corporations will start issuing financial instruments (shares, debt) on the blockchain via tokenisation thereby opening the door for the fiat sector to adopt crypto/digital assets at scale

- New identity services: We believe new identity services (solving for AML/KYC, onboarding) will grow for each Layer 1 protocol and create bridges across protocols (and maybe via wallets)

Application layer

- New applications: There will be an emergence of new category killers in the areas of brokerage, market making and analytics across all Layer 1 protocols

- Rise of the metaverse: Metaverse concepts will seep through the retail world and merge with the gaming industry to provide novel user experiences. Financial services providers will morph their distribution channels to interact in metaverse. The metaverse will at first focus on the retail world but will quickly develop in the B2B world too. B2B marketplaces, where financial services components must be present, will grow to become the next dominant platforms

- Metaverse distribution: Simply put, we will see an emergence of neo banks, savings startups, lending startups, robo-advisory start-ups, InsurTech startups and many others focusing on metaverses, specialising by affinity, geography, or both

Access layer

- Institutional grade wallets: The post-issuance value chain will be ruled by institutional grade wallets, thereby completely upending the traditional relationship buy side participants (capital markets, asset management) enjoy with their service providers (notably custodians)

- Wallet services: The institutional grade wallet will serve as a central nervous system from which services will be plugged in to and from which transactions will be confirmed and assets will be secured and manipulated

All Layers

- We expect a strong push towards interoperability. This should be viewed on two different levels:

- Interoperability in terms of deploying services across protocols (Layer 1 or 2)

- Interoperability in terms of extracting/analysing/sharing/monetising/protecting data across protocols for all activities pre and post trading (investment analysis, issuance, accounting, reporting, compliance, tax calculations)

As such, we will see the emergence of new opportunities around on/off chain data sharing, oracles-as-a-service and solutions that cater directly to the Web 3.0 developer ecosystem. We believe both user experience and security has been overlooked by start-ups who have focused on products and service to get to market as quickly as possible. Thus, there will be a necessary “catch up” as institutional standards are imposed by a combination of market discipline and regulatory necessity.

In summary, although the digital assets and crypto innovation cycles are still in their infancy, the next few years will lay the groundwork for a multi decade transformation.

———

If you would like to find out more about our MGV FinWeb 3.0 thesis, see here.

Launching a venture in the digital asset and blockchain space? Want to pitch us? We’re seeking outstanding entrepreneurial teams who are reimagining the new financial services architecture. If that’s you, get in touch here.