As we continue to put money to work in our latest fund at MiddleGame Ventures (“MGV”), we have completed a series of deep dive reviews of the FinTech startup landscape in B2B and B2B2C financial services to help structure how we prioritize our efforts across the broader fintech ecosystem. This blog, the fifth in a series, is focused on Environmental, Social, and Governance or “ESG”. The title of this blog, “Embedded ESG” is quite meaningful. After decades of public discussion and largely unsuccessful attempts in the investment community, ESG-associated issues have moved past the “analyze & argue” phase and is now entering the “implementation” phase. While admittedly broad, ESG for our purposes, in financial services and fintech, is a relatively new (and welcomed) entrant into the startup world. After six months of research, we believe there are exciting new opportunities in FinTech ESG.

My own journey (Michael) is relevant and emblematic of the segment’s evolution. At university, I participated in “divestment” protests which demanded that the Yale Endowment divest all investments that were somehow connected to South Africa and the Apartheid regime. This was my first glimpse into the power of shareholder activism and it served as a powerful lesson. Next, I wrote a graduate thesis on “Socially Responsible Investing” or “SRI”. SRI was the precursor to ESG but, as my paper would attest, did not have a solid set of data and relatively poor conclusions (ie correlation vs causation was difficult to prove). Unfortunately, that early data actually showed that SRI investing chronically underperformed the market. My next step at Wellington Management Company was to manage a “green fund”. Again, using poor sorting tools, I was only able to identify “not bad companies” for investment. It was a frustrating experience. Various entities have attempted to improve the tools and results over the years, with little real progress.

All of which brings us to the present. After our deep dive research, we can safely say that “this time is different”. The data, tools, systems, regulations, investor sentiment, and technologies have all combined to create ESG’s moment, its Phoenix if you will. Innovation in the sector is booming, and exciting. We believe that investors, regulators, and the general public will no longer tolerate ESG as a mere reporting element. ESG will now be required as an embedded element of operations, recruiting, results, and outcomes. In order to facilitate that massive change, new technologies will be required.

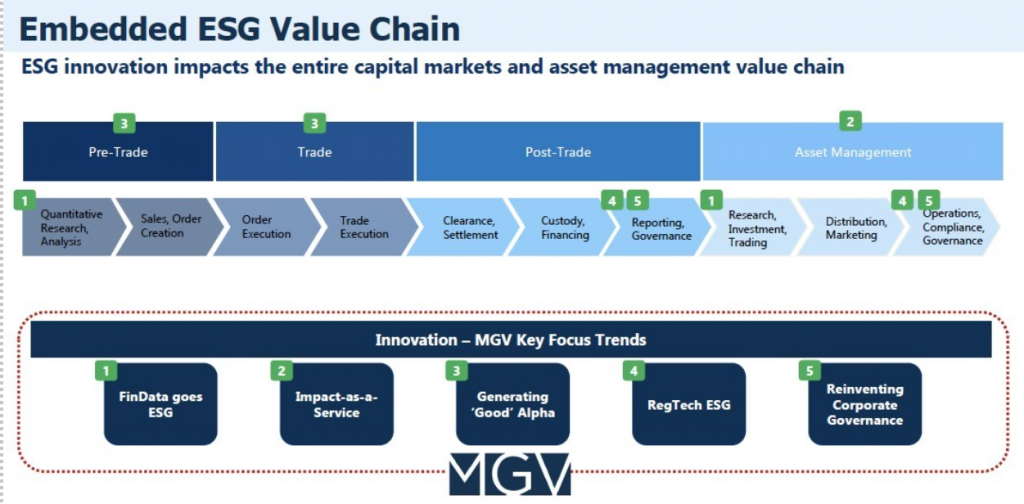

Our research included a wide scan across Europe for self-identifying ESG startups. We uncovered a number of startups and just as importantly, 5 Key Trends in the “Embedded ESG” innovation community which we will discuss further below:

- FinData goes ESG

- Impact-as-a-Service

- Generating “Good” Alpha

- RegTech ESG

- Reinventing Corporate Governance

MGV is actively looking to invest in Europe’s best FinTech ESG companies. Please contact us if you have interesting ideas!

We have organized our research and investment efforts around five key trends that will influence a cross-section of functions within and beyond the financial services landscape:

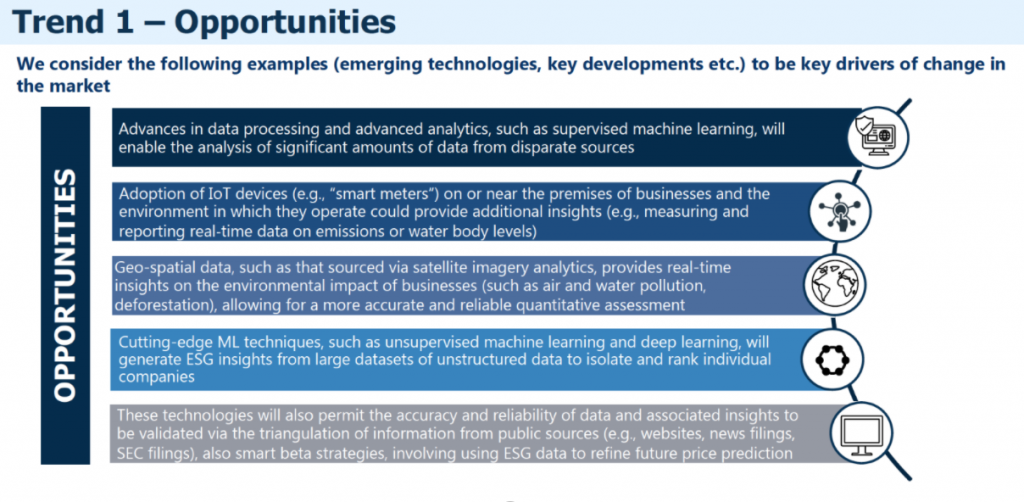

- FinData goes ESG

The accumulation of data and development of analytical tools – a financial data ecosystem that we have termed FinData – is central to the new ESG landscape. Market participants overwhelmingly state that data is the #1 barrier to ESG adoption. Accordingly, the availability of vast amounts of new data (whether from unstructured data, new asset classes, or current data spun out from a business) will drive increased ESG functionality around data analysis, collaboration, and decisioning, including through the use of new technologies such as AI or quantum computing. Separately, the proliferation of alternative data sets driven by advanced data mechanisms or new asset classes will see tremendous growth over the coming years as investors seek alpha and more robust analytical models. We are most attracted to startups and teams that are working towards facilitating or unlocking coordination, be it via AI, advanced data analytics, cryptography/blockchain technology, APIs, or cloud computing.

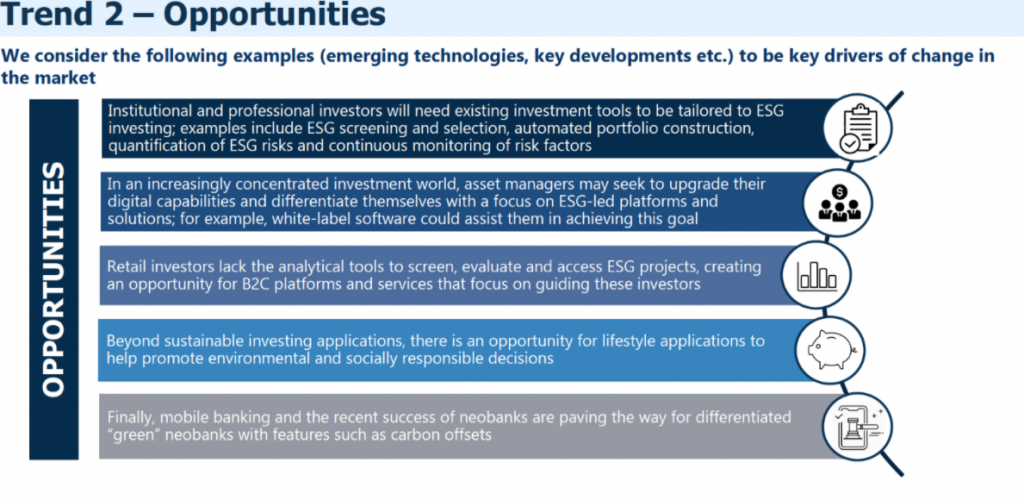

- Impact-as-a-Service

We have long been vocal advocates of platforms and marketplaces as effective business models in FinTech generally. ESG is no different and in fact may be even better suited. The industry does not need single solution “products”. It needs a broad spectrum of tools, systems and services in easy-to-use platforms that automate many of the key reporting and compliance functions as well as more value-add opportunities (ie new green asset issuance platforms etc).Indeed, there have been platforms in the past, as referenced earlier, back to the 1990s. However, those platforms were typically screening/sorting tools that were spreadsheet intensive and usually focused on negative screening. Next gen tools, which are being built now, move well past passive screening and manual reporting. These tools will allow investors and institutions access to more data which provides the ability to tailor investment approaches to specific goals. These systems include basic adherence to compliance reporting but also have the ability to create alerts, to customize portfolios, and to identify new asset opportunities.We have an investment in Railsbank, a pioneering leader in “Banking-as-a-Service”. Railz offers clients the opportunity to access banking systems in “five lines of code”. We look forward to investing in startups that offer “Impact-as-a-Service” in five lines of code.

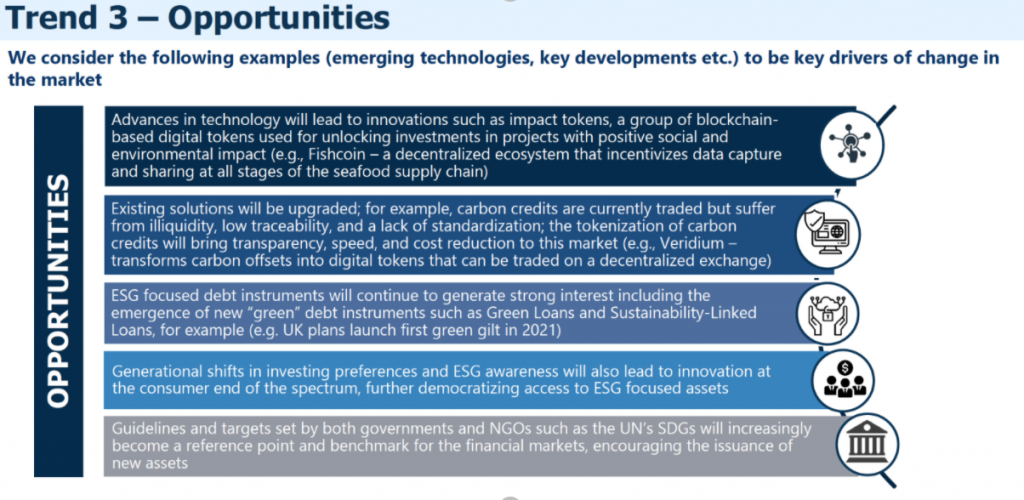

- Generating “Good” Alpha

For decades, not doing “bad” things was the operating mantra in Socially Responsible Investing and/or green investing. But, those negative screens typically produced sub-optimal financial returns and rarely delivered satisfactory ethical returns. By not investing in fossil fuel-based companies, investors could feel good about their green goals but the strategy presents two significant challenges. First, if a manager is investing in a decade where oil & gas outperforms the market, green fund managers will face uphill performance challenges which usually results in shrinking AUM if not job insecurity. Second, investors (both incumbent institutions and end retail customers) do not positively impact climate change (in this example). Yes, divestment helped to contribute to the fall of Apartheid but the effect was indirect and not particularly fast.This is all changing, thank goodness. Green bonds, sustainability loans, carbon credit trading and blockchain-based supply chain management tokens are examples of ESG assets that deliver real returns and will eventually (we suspect) create outperformance alpha (and solid beta as ESG ETF products proliferate).MGV is looking for ESG asset generation platforms (new issuance or trading), index creation systems, and DeFi or CeFi exchanges that enable alpha generation opportunities from ESG assets.

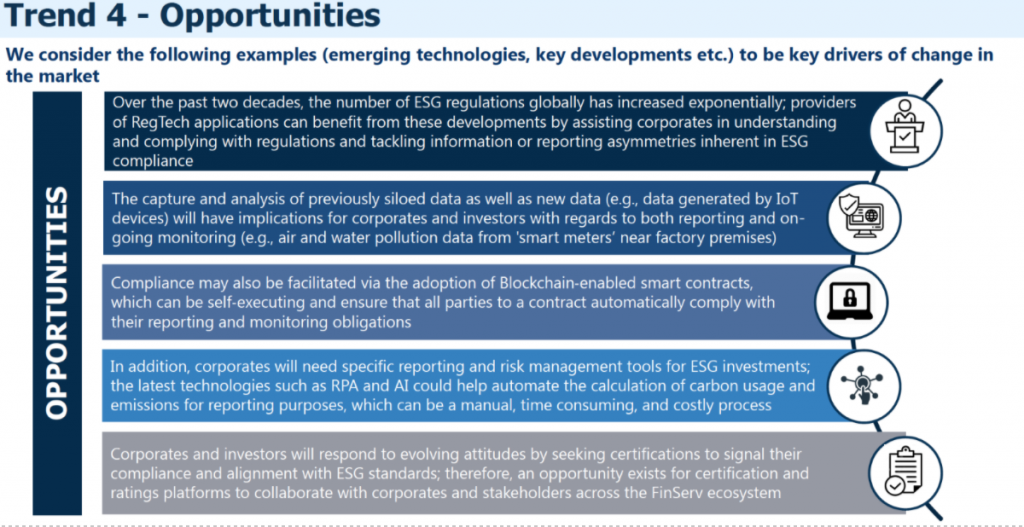

- RegTech ESG

Regulation usually, and hopefully, reflects public opinion/will albeit slowly. Over time, we have seen gender and racial equity issues addressed for example. However, these issues were not addressed directly in asset management (nor were climate change challenges). This is changing and rapidly. EU regulation covering equality, climate change, and governance is forcing a sea change in behavior and compliance. Remaining compliant is a basic tenant of market behavior but surprisingly, few tools and systems are available for regulatory compliance and reporting in ESG categories. The area is ripe for short term innovation. Further, more sophisticated systems are in development using, for example, IoT to track environmental impact, data mining tools to identify ESG trends, or blockchain-based smart contract systems that auto-verify compliance. MGV is actively looking for RegTech ESG platforms and ecosystems (DeFi for example) that are on the cutting edge of positive ESG compliance.

- Reinventing Corporate Governance

This last trend is perhaps most important and simultaneously least understood. Despite early efforts around divestment, to the decades-old pressure to diversify workforces and Boards, to ever present “activist” investing, Governance in today’s markets, particularly public markets, remains problematic. It is neither transparent nor effective in general. When considered in the ESG context, Environmental and Social issues remain largely in the realm of “virtue signaling” by incumbents as opposed to real, sustainable change.Current Governance systems are antiquated and hardly sufficient to cure deep ESG problems. However, we believe that change is coming and it will be incredibly consequential. Imagine a world of radical transparency where investors know all of the relevant key metrics that drive ESG outcomes. Racial and gender equality can be measured to the person. Climate change data can be analyzed at the point of incident, individually by an IoT sensor for example. And, Governance can be transparent, direct, and fully democratic as opposed to opacity & disconnecting voting processes.Indeed, that will be a sea change. MGV is looking for the leaders in this emerging trend, particularly those teams focused on using smart contract, self-executing systems to prosecute ESG governance.

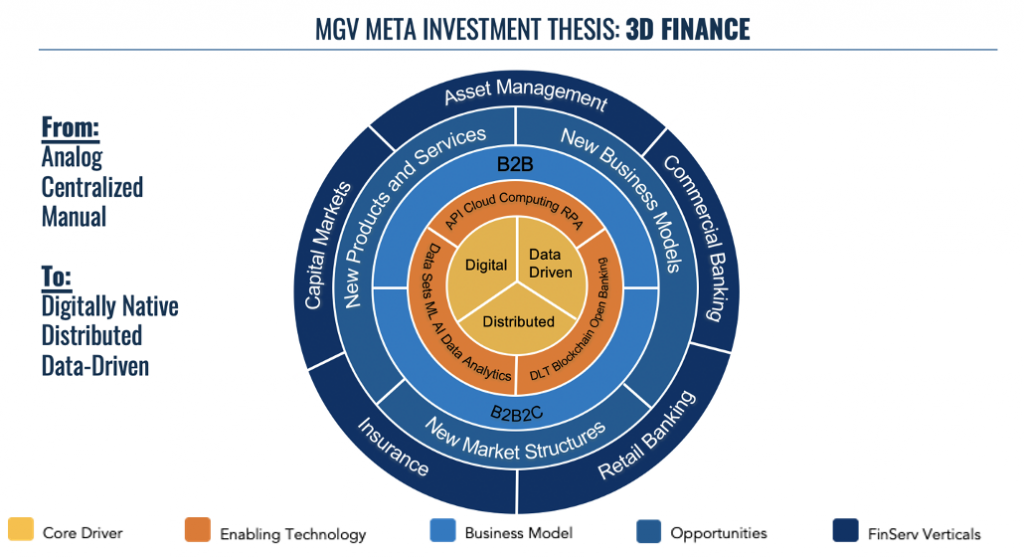

3D Finance

These focus trends in Embedded ESG tie into MGV’s “3D Finance” meta thesis, which encompasses the transformation of financial services around a core of Digital, Distributed, and Data-Driven processes. Within the 3D Finance construct, we have further developed investment themes that focus our attention on the transformation that is just beginning to unfold across the financial services industry, many of which were highlighted on MGV’s introductory blog.