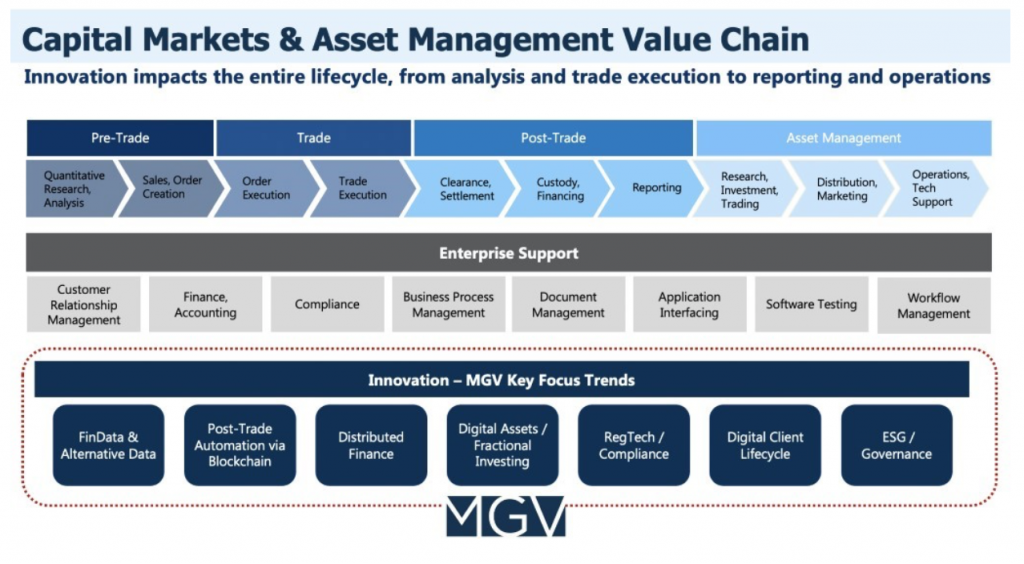

As we begin to put money to work in our latest fund at MiddleGame Ventures (“MGV”), we have completed a series of deep dive reviews of the FinTech startup landscape in B2B and B2B2C financial services to help structure how we prioritize our efforts across the broader fintech ecosystem. This blog, the third in a series, is focused on Capital Markets & Asset Management (CM & AM). CM & AM includes the asset issuance, investing, trading, and post-trading life cycle of investable assets, as well as new marketplaces, tools, and infrastructure. Technology promises a revolutionary shift in the financial services sector, a departure from incremental, evolutionary product development that has largely defined CM & AM until now.

CM & AM will undergo market structure transformations characterized by shifting data asymmetries between actors, the rise of new digital asset classes, and a reduced reliance on centralizing agents. We believe that these changes will create avenues for the emergence of new products, marketplaces, and platforms for engagement between providers and consumers of financial products, creating a virtuous cycle of innovation. For example, the automation of trade processing and post-trade clearing and settlement via DLT will provide significant capital savings and cost efficiencies to both the buy and sell side, while also decreasing friction, minimizing operational risk, and boosting transparency—key aims of regulators.

Fundamentally, the emergence of a digitally-native infrastructure will quicken the pace of digitization. Just as liquidity begets more liquidity, digitization will drive more digitization. The joint application of cloud computing, APIs, SaaS models, advanced data analytics and DLT post-trade infrastructure will usher in an era of open capital markets and open asset management akin to the open banking trend. Similarly, friction and costs will be reduced, and markets will become more open and accessible which will exponentially increase liquidity and the velocity of transactions. While this dynamic is inherent to the growth of a cross-section of asset classes, we expect that the scale and scope of these changes driven by a fundamental rewiring of the CM infrastructure will be unprecedented.

MGV has already invested in five companies that are championing trends across various subsectors in this space (Coinfirm, Keyrock, Nivaura and Next Gate Technologies). Our research has uncovered over 950 other early stage startups attacking the opportunity across the multiple vectors outlined below. Simply put, there is significant energy and resources be putting to work across the capital markets and asset management landscape.

Seven MGV Focus Trends in Capital Markets & Asset Management

We have organized our research and investment efforts around seven key trends that will transform a cross-section of functions within and beyond the financial services landscape:

- FinData & Alternative Data The accumulation of data and development of analytical tools – a financial data ecosystem that we have termed FinData – is central to the new landscape. Accordingly, the availability of vast amounts of new data (whether from unstructured data, new asset classes, or current data spun out from a business) will drive increased functionality around data analysis, collaboration, and decisioning, including through the use of new technologies such as AI or quantum computing. Separately, the proliferation of alternative data sets driven by advanced data mechanisms or new asset classes will see tremendous growth over the coming years as investors seek alpha and more robust analytical models. We are most attracted to startups and teams that are working towards facilitating or unlocking coordination, be it via AI, advanced data analytics, cryptography/blockchain technology, APIs, or cloud computing.

- Post-Trade Automation DLT and other technologies will transform the ancient and capital-intensive clearing, settlement, and custody infrastructure. While past innovations in CM have been heavily focused on pre-trade and trading functions, post-trade services remain highly inefficient, opaque, and paper-based. We believe that core infrastructure upgrades will improve market functioning and spawn a new ecosystem of innovations across the post-trade lifecycle, including clearing & settlement, as well as custody (particularly the self-custody of assets, which will have broader repercussions across multiple trends highlighted in this report). In particular, post-trade automation is a clear use case for DLT, with prominent industry-wide projects underway globally across asset classes and transaction mediums (e.g., primary bond issuance, OTC derivatives). This promises to be a force multiplier for current market functioning, while also providing the rails for a host of new innovations.

- OmniFi OmniFi, as outlined in a prior blog post, is our term for the financial services spectrum spanning the current centralizing characteristics from Centralized Finance (CeFi) to the emerging power of Decentralized Finance (DeFi) while encompassing a host of applications (tokenization, fractionalization) that are being built on top of blockchain systems. Fractionalization and tokenization can straddle both the centralized and decentralized worlds within OmniFi. Innovation is happening at both ends (DeFi and CeFi), and we expect convergence over the medium-term in these structures. Unlocking value in this segment is premised on private/public key technology, which would allow for the complete revamping of the custody of assets, and thus pioneering an entirely new ecosystem by giving the asset holder ultimate control (in this case, custody) over one’s assets.

- Tokenization & Fractional Investing Technology will seed widespread tokenization / fractional investing across nearly all asset classes, including physical assets such as crude oil or real estate, financial assets such as stocks or other securities, and, of course, crypto assets – driving issuance, trading, and custody innovation. New ways to issue digital assets across various mechanisms and underlying asset classes will create new marketplaces to trade and custody these products. All tokenized assets are fractionalized, but it is important to note that not all fractionalized assets need be tokenized. This is fundamentally a force multiplier as new asset classes and the repackaging of existing asset classes for the digital age — coupled with increased interoperability and fungibility across assets (less friction buying and selling or swapping between assets, less friction fix wise, less friction custody wise) — will empower investors to pursue novel investment strategies untethered to legacy infrastructure.

- RegTech & Compliance We believe that compelling supply and demand variables will slowly seed traction in the use of technology by financial institutions and regulators for compliance and risk monitoring. Regulatory compliance represents a huge pain point with emerging technologies offering a better, faster and cheaper approach. The next generation of RegTech give rise to new data sets, forensics/compliance across asset classes (both current and new), and novel ways of assessing/pricing/managing risk. This trend will encompass what we call Compliance-as-a-Service, enabling incumbents and small firms alike to manage their regulatory burden. We expect that global regulators will ultimately follow the example of the FCA in the UK and begin pushing for automated compliance controls (opportunity for regulatory system to get more insightful data earlier and at scale, to examine prudential and systemic risks), thus easing adoption and internal friction at many institutions. Importantly, increased connectivity across institutions and platforms and regulators will drive an additional tailwind for cyber, privacy, and security efforts.

- Digital Client Lifecycle Consistent with a platform approach to the customer relationship, it will be necessary for incumbents to provide a seamless client experience from onboarding to client reporting to product offering. We see a host of opportunities centered around improving the existing client experience through greater efficiencies or adding new functionality and products to deepen touchpoints with existing clients/customer segments that may have previously been more difficult to service in an economical fashion (e.g., SMEs, mass affluent private banking services). We are focused on startups that either provide meaningful revenue enhancements to incumbents through new product functionality, client sourcing and data aggregation, or deliver significant cost-savings through streamlined back-office infrastructure. Examples here include: 1) Digital core offerings; 2) open source infrastructure; 3) AI/NLP-based documentation technologies; 4) gamification; 5) integrated onboarding tools; and 6) client generation and associated client/data aggregation tools.

- ESG & Governance While Environment and Social are vital to the equation, Governance is our key focus when it comes to ESG innovation across financial services. The “G” in ESG will be driven by data in a distributed fashion, paving the way for potential structural changes in the issuer/buy-side relationship. Shareholder and corporate governance will have much more teeth versus the largely pro forma proxy voting system if investors are able to vote or otherwise impact how an investment is managed. This could fundamentally alter the role and influence of the investor class. In a financial future with private/public keys, we can think about the merger of proof of stake and governance that are controlled by the asset holder and where activism and voting take on a completely different meaning, whether baked in the code of a particular asset or a posteriori. So in other words, ESG is not only about “new asset classes” but potentially the much more powerful ability for the buy-side to have fully actualized ESG directives via transparent and direct governance.

3D Finance

These focus trends in Capital Markets & Asset Management tie into MGV’s “3D Finance” meta thesis, which encompasses the transformation of financial services around a core of Digital, Distributed, and Data-Driven processes. Within the 3D Finance construct, we have further developed investment themes that focus our attention on the transformation that is just beginning to unfold across the financial services industry, many of which were highlighted on MGV’s introductory blog.