MGV GP Letter / 4th Quarter 2023

“Come what may, all bad fortune is to be conquered by endurance.” Virgil – Roman poet 1st century BC

Read more

9 November 2023

Finding Opportunity Amidst a Global Regulatory Recalibration

24 October 2023

Our Investment in Ctrl Alt

22 September 2023

The Importance of Cyber Resilience in Financial Services

20 September 2023

Our Investment in Kayna

10 August 2023

Time to Recalibrate

28 June 2023

Our Investment in One Trading

24 April 2023

The Great Reset

14 April 2023

Next Gate Tech Announces €8M Funding Round

28 February 2023

Our Investment in Finoa

11 November 2022

Our Investment in UrbanFox

20 October 2022

Our Investment in Outmin

3 October 2022

Our Investment in NoFrixion

23 September 2022

2022 Venture Scholar Programme

1 July 2022

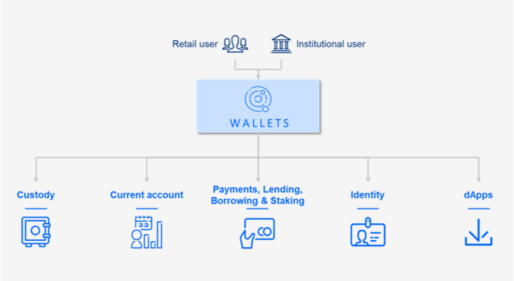

Wallets Are Eating Financial Services

27 June 2022

Our Investment in &Open

9 June 2022

Next Gate Tech Announces €5M Funding Round

19 May 2022

Our Investment in Circit

26 April 2022

Our Investment in Conjura

7 April 2022

Our Investment in Trustap

22 November 2021

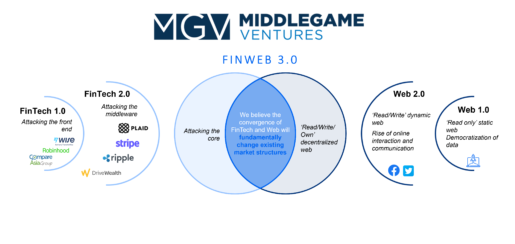

The Fundamental Re-Architecting Of Financial Services

8 October 2021